We (the 👑 we) invest $300K-$500K at the earliest stages in AdTech, Ecomm Enablement, NextGen Commerce, Vertical SaaS, Fintech, & Marketplaces.

-

We partner with early stage companies anywhere on the spectrum: from inception to startups with significant traction ready to raise their pre-seed (angel) or seed rounds. (We’ve even invested in a few entrepreneurs with ideas to change the world but no formal business plan). If this sounds like you, get in touch via the form below. We’re also available to help scope out your TAM, workshop business models, and discuss product-market fit. Don’t be shy!

-

Simply put: we get our hands dirty. As former founders and operators, we’ve been in the trenches before. Our team works directly with founders to understand their needs: whether it’s access to capital or something else like hiring the right team, finding office space, or pivoting to the correct strategy - we’re there every step of the way. The question isn’t if we can help you raise capital - it becomes how much, how quickly, and from which funds.

-

We move quickly but we’re in this for the long haul. We’re looking for long-term partners. Our team works alongside you before, during, and after the raise (and any subsequent raises). Our goal is to continue to be a resource to you throughout your company’s life-cycle. We are fully focused on your success. Most critically, we invest in you and your idea as early as we can.

irrvrntVC Fund I Portfolio

-

Vint

Vint is the first fully transparent wine investment platform enabling you to own SEC-qualified shares of the best wines in the world.

We invested in Vint’s pre-seed round in Q4 2021. We invested again in Vint’s seed round in Q3 2022.

-

RevenueRoll

RevenueRoll provides cash to clients to fund marketing campaigns and manage the distribution of funds across various advertising channels.

We led RevenueRoll’s pre-seed round in Q4 2021.

-

Smarty

Smarty is the #1 productivity tool to simplify, streamline, and scale yourself and your business.

We invested in Smarty’s pre-seed round in Q4 2021.

-

Pack Digital

Pack Digital is your modern storefront for Headless Commerce.

We invested in Pack Digital’s seed round in Q1 2022.

-

Adapty

Adapty helps companies run monetization experiments 2х faster and cheaper and increase app revenue by 30%+.

We invested in Adapty’s seed round in Q1 2022.

-

Split

Split lets influencers share their commission with their followers.

We led Split’s seed round in Q1 2022.

-

Roomie

Roomie is a better way to plan and shop for your space. Their interactive 3D models empower residents to lock down their room layout and take the drama out of move-in day.

We invested in Roomie’s pre-seed round in Q2 2022.

-

Mayple

Mayple enables DTC brands to become international retailers with the click of a button.

We invested in Mayple’s pre-seed round in Q2 2022. We invested again in Mayple’s seed round in Q3 2023.

-

nGrow

nGrow powers smart push notifications to boost revenue and engagement. They leverage data, AI, and segmentation to drive results.

We invested in nGrow’s seed round in Q2 2022.

-

Lynk

Lynk builds closed loop payment systems for merchants so they can save on fees and increase loyalty.

We invested in Lynk’s seed round in Q3 2022.

-

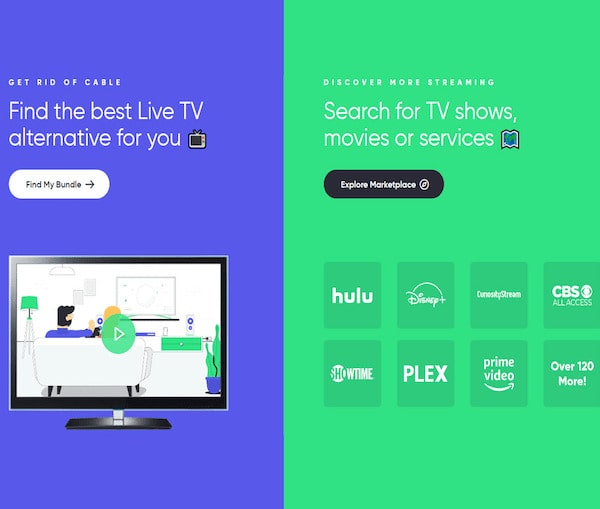

Vendo

Vendo lets you launch multi-vendor marketplaces with no code and no inventory.

We invested in Vendo’s pre-seed round in Q4 2022.

-

Skipti

Skipti powers turn-key circular commerce solutions that inspire consumers to live deliberately and sustainably.

We invested in Skipti’s seed round in Q1 2023.

-

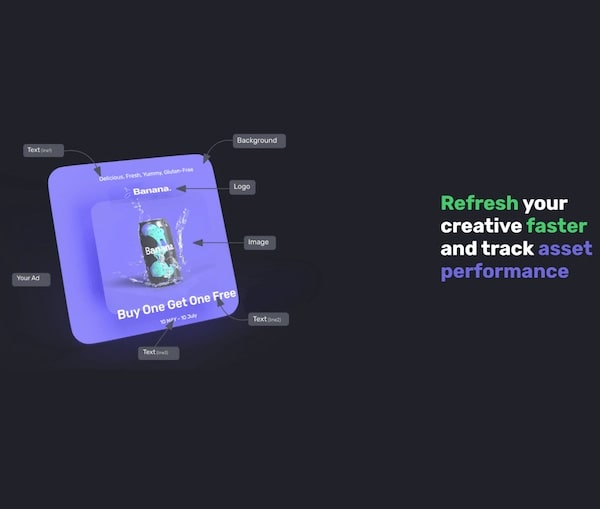

OpenAds

OpenAds is building the SSP for Generative AI with prompt-relevant ads that fit your UX.

We led OpenAds pre-seed round in Q2 2022.

-

Trufl

Trufl powers reservation bookings and payments for local restaurants.

We invested in Trufl’s seed round in Q2 2022.

-

Monocle

Monocle is building an OS for discounts so you can stop spending 15% of GMV on one-size-fits-all promotions.

We invested in Monocle’s seed round in Q2 2022.

-

SparkLayer

SparkLayer is the powerful platform that transforms your existing website into a fully featured B2B solution.

We invested in SparkLayer’s pre-seed round in Q2 2023. -

DayZero

DayZero is the modern ERP for F&B brands selling through mutliple channels.

We inveted in DayZero’s pre-seed round in Q3 2023.

-

Rove

Rove is the best way to book modern, fully-furnished, long-term stays in NYC.

We invested in Rove’s seed+ round in Q3 2023.

-

Rivertel

Rivertel is a MVNO targetng immigrant communities in the US. Their plans include superfast, reliable coverage at low prices. All with international calling & high speed 5G data.

We led Rivertel’s pre-seed round in Q4 2023.

-

Visually

Visually is the next-gen Optimization & Personalization Platform. Fueled by data and AI, Shopify brands take control over their site with no-code.

We invested in Visually’s seed round in Q4 2023.

-

TapStitch

TapStitch is leading the POD Revolution with 1000+ streetwear products. Enjoy no MOQ, no upfront cost, fast delivery, branding services, and excellent payment terms.

We invested in TapStitch’s seed round in Q4 2023.

Mission Impossible? We don’t think so.

Mission Impossible? We don’t think so.

We believe the process is broken and we want to play a part in fixing it. We’re former founders and business operators who want you to learn from our successes AND our failures. We’ve worked for and advised some of the most successful and fastest-growing companies including Amazon, Shake Shack, Nike, Intuit, Rothy’s, Helix Sleep, Spanx, Glamsquad and Bandier. When you partner with us you get to leverage our experience, our knowledge and know-how, our network, and our capital.

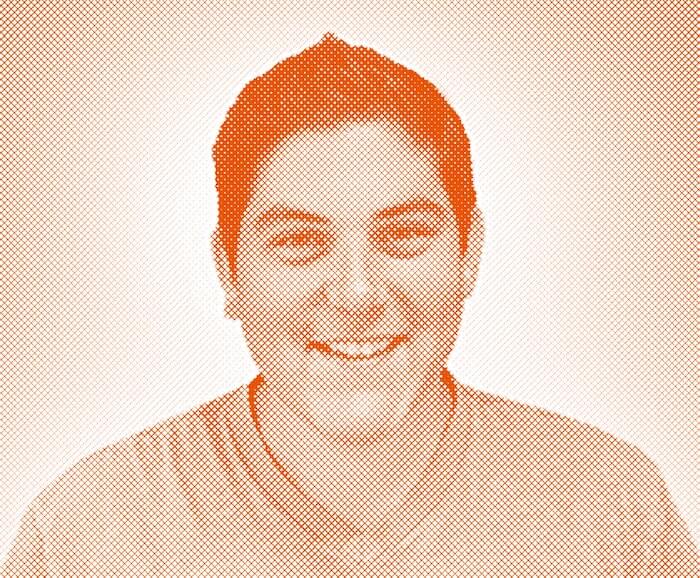

The man behind the scenes. Andrew Gluck

Andrew Gluck is the GP of irrvrntVC, a firm focused on early-stage companies in the DTC, AdTech, and NextGen Commerce areas. He especially loves partnering with first-time founders so they can learn from his mistakes. Prior to that he co-founded and ran Agency Within, the largest independent digital marketing agency with a focus on direct-response, data-driven marketing. He managed close to $1BB in spend for clients like Nike, Billie and Zola.

Andrew Gluck is the GP of irrvrntVC, a firm focused on early-stage companies in the DTC, AdTech, and NextGen Commerce areas. He especially loves partnering with first-time founders so they can learn from his mistakes. Prior to that he co-founded and ran Agency Within, the fastest-growing independent DMA with a focus on direct-response, data-driven marketing. He managed close to $1BB in spend for clients like Nike, Billie, Zola, Outdoor Voices, Goop, and Etsy.

The man behind the scenes. Andrew Gluck

Andrew Gluck is the GP of irrvrntVC, a firm focused on early-stage companies in the DTC, AdTech, and NextGen Commerce areas. He especially loves partnering with first-time founders so they can learn from his mistakes. Prior to that he co-founded and ran Agency Within, the largest independent digital marketing agency with a focus on direct-response, data-driven marketing. He managed close to $1BB in spend for clients like Nike, Billie and Zola.

Shut up & take

my money

Shut up & take

my money

88% chance that you came here to get in touch to pitch us on your latest and greatest whizbang. Well we’re here for it. Please submit the form below and we’ll be in touch. (Yes someone, Andrew, actually reads these submissions and replies to every single one, usually within 2-3 weeks.)

irrvrntVC is proudly anchored by Apple Core Holdings.

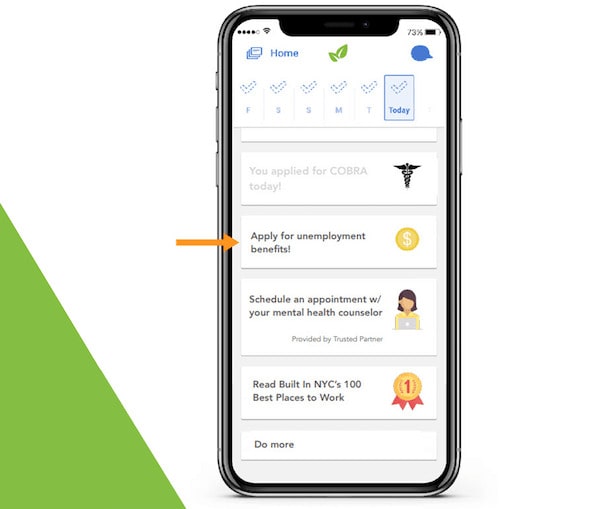

You get credits! And you get credits!

Access to $250k+ in credits,

including $100k in AWS Credits!

We are privileged to partner with the following institutions and startups to provide credits and discounts for portfolio companies.

Prior Angel Investments

1/

— Andrew Gluck (@irrvrntVC) June 26, 2020

Here's my thesis on investing in DTC.

Experience comes from co-founding the largest independent DMA in the US and working with DTC brands like @HelixSleep @rothys @billiebody @TommyJohn + ~50 more. pic.twitter.com/eILPvA9uBV

Founders, the easiest way to ensure your deck isn't shared w/o your permission -- make it larger than 25MB (gmail's limit).

— Andrew Gluck (@irrvrntVC) May 27, 2020

Andrew's Top 10 Fav Resources

01

Secrets of Sand Hill Road

This book by Scott Kupor is one of the best guides on how the venture capital industry works and on how VC’s think. Highly recommend you read before / as you go out to raise.

02

My Recommended Deck Structure

Here’s a deck structure I’ve used and recommend to portfolio companies. It’s simple + straightforward, and ensures you are checking all the boxes VC’s like to see.

03

Founder-Market Fit

Jillian Canning, Startup BD at AWS, has a great article on Founder-Market Fit: how to find it, why it's critical, how to highlight it, plus a few examples to learn from.

04

Schlaf's Founder Library

Steve Schlafman has put together a tremendous "high-output founder library" of resources for founders on everything from fundraising to self-care to legal.

05

Media that VC's Consume

Great crowdsourced list of the media VC’s and founders consume including newsletters, articles, podcasts, and more.

06

Airtable Fundraising Template

Fundraising can be hectic; ensuring you are organized is paramount. This is a great Airtable template to help you track meetings, followups, etc.

07

645 Cap Table Simulator

Raising capital is a critical part of the VC-backed-company journey, but you also want to understand how you are being diluted. 645 put together a great simulator so you can play around with different scenarios and see the outcomes.

08

DTC Checklist

Roger Chen, Partner at Silverton Partners, put together a great list of the table stakes for DTC companies including profitable unit economics, tracking cohort data, and shipping / fulfillment needs.

09

Monthly Investor Updates

Reza Khadjavi, the Founder of Shoelace, explains how providing regular (monthly) investor updates helped them not only raise capital but also run a better company by providing strategic alignment, vision, execution.

10

Capiche Discounts List

Capiche, a secret society for SaaS power users, compiled a great list of discounts for some of the most commonly used software.